President Bola Tinubu has got off to a flying start in rebooting Nigeria.

Within two weeks of being sworn in, he’s abolished costly fuel subsidies, and signaled that he will overhaul a dysfunctional currency system, allow foreign investors to repatriate their profits unhindered and make electricity more available and affordable.

Then last Friday, the president suspended controversial central bank Governor Godwin Emefiele who was subsequently detained by Nigeria’s State Security Service.

An election poster for Tinubu and his running mate in Lagos in February. Photographer: Benson Ibeabuchi/Bloomberg

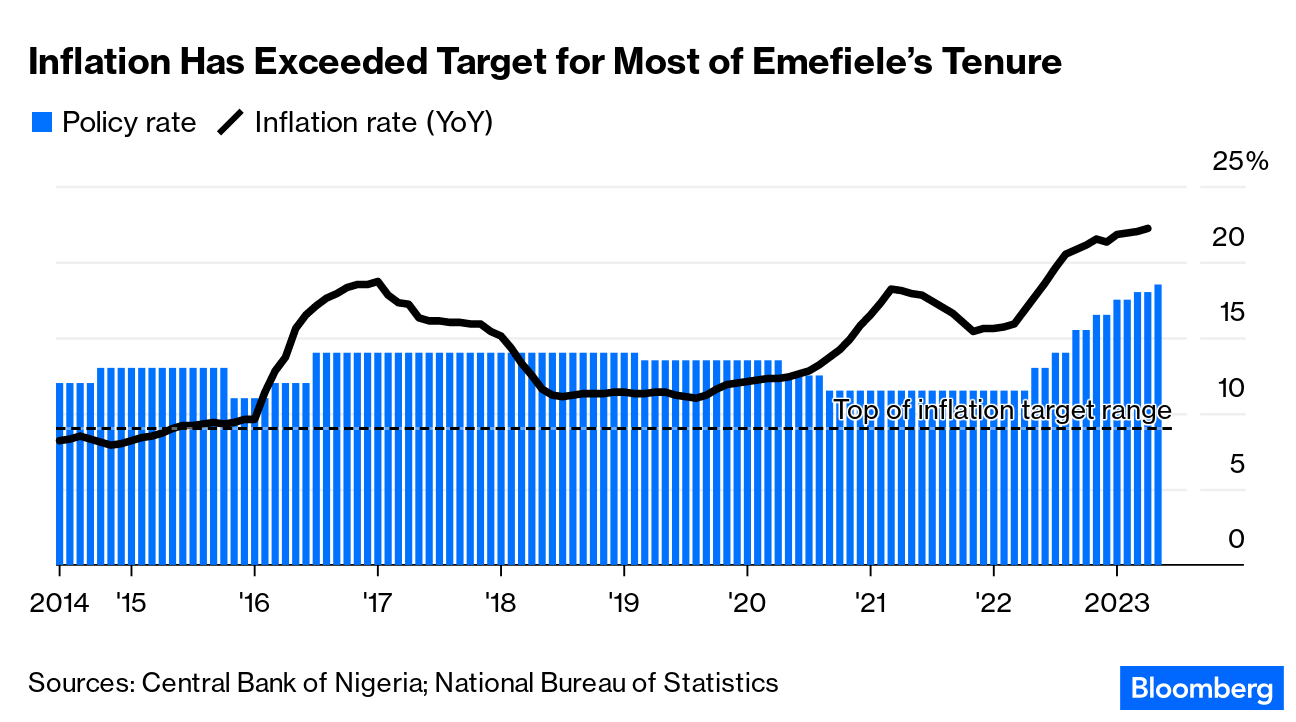

Emefiele’s exit could usher in more orthodox approach toward monetary policy.

During his tenure, the central bank loaned billions of dollars to the government, helping push public debt to a record $164 billion, and oversaw a complex system of multiple exchange rates that drove businesses and citizens alike to the black market.

A Tinubu adviser says the shift to a single rate is “imminent” and the naira has fallen to a record in anticipation it will be adjusted to closer to the parallel-market rate.

Africa’s biggest economy desperately needs a comprehensive policy reset.

Almost two-thirds of the country’s more than 200 million people lack access to basic necessities, unemployment is rampant and inflation is at an 18-year high. Servicing government loans consumed 96% of its revenue in 2022 and the figure could top 100% this year.

While Tinubu must still prove his commitment to follow through all the pledges, the scrapping of gasoline subsidies, which cost the government $10 billion last year, suggests he’s prepared to take difficult political decisions.

For now, investors appear to be giving the 71-year-old leader the benefit of the doubt, with debt markets rallying.

Public reaction, though, will test his resolve — transportation costs have skyrocketed, causing chaos at filling stations and a call to strike by the main labor union.